Demand for Information and Stock Returns: Evidence from EDGAR

Abstract

This paper empirically shows that information acquisition affects stock returns by reducing firm-level information asymmetry. When firms disclose material information known by insiders, information acquisition reduces asymmetric information and lowers stock returns. The effect is stronger for both unexpectedly good and bad news relative to anticipated news and when investors’ cost of information processing is lower. Using the Northeast Blackout of 2003 as a natural experiment, I explore an exogenous shock in information acquisition and show causal evidence that information acquisition reduces information asymmetry.

Does information acquisition reduce information asymmetry and lower stock returns going forward?

Depending on the model specification and the underlying assumptions, theoretical works argued that the result can go in either direction. Empirically, however, no papers has examined the relation between information acquisition and information asymmetry.

The ideal experiment to answer the question would be the following:

Given two identical firms with the same release of information, we observe an exogenous variation in the subsequent information acquisition. Then let’s compare the information asymmetry and stock returns between two firms going forward.

Empirically, this is VERY HARD for the following reasons.

Measure information acquisition: Existing measures of information acquisition do not keep track of the information content collected by investors. For example, when we see a spike in Google Trends, all we know is that there are lots of people searching. But we don’t know exactly what information is collected by investors.

Endogenous supply of information: Managers may have incentive to supply information when the information asymmetry is high. Such incentive of strategic disclosure is unobserved but correlates with subsequent information acquisition and information asymmetry.

Endogenous demand for information: Investors may anticipate the information release (eg., Earnings Announcement). Reverse causality could be true: high information asymmetry firms attract more information acquisition.

To overcome these concerns, I focus on investors’ information acquisition on the EDGAR platform, which keeps track of each filing download request made by investors. I then focus on unscheduled mandatory 8-K filing and subsequent 8-K downloads, which greatly alleviate the concerns of endogenous disclosure from supply side and anticipated information acquisition from demand side. I also use a natural experiment to establish the causal effect of information acquisition on information asymmetry.

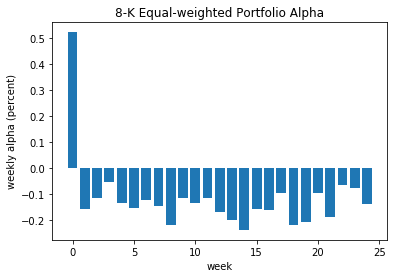

Looking at return patterns: Conditional on a set of firms with 8-K release, 8-K downloads predict a lower and persistent reduction in stock returns going forward. Consistent with the reduction in risk of holding the asset, contemporaneous price jumps up.

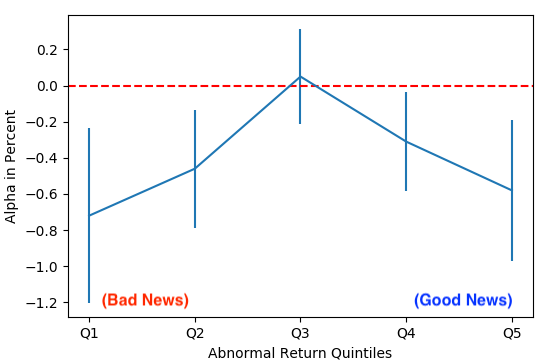

The lower subsequent return is not simply driven by the information content. For example, an alternative story would be that high downloads are associated with bad news, and bad news tends to be persistent. To rule out this explanation, I show that 8-K downloads predict lower returns for firms with both good news release and bad news release. The following figure shows the 8-K portfolio alpha and its 95% confidence interval conditional on the information content. For either the good or bad news, information is unexpected by the market. Therefore, learning about the information can greatly reduce the uncertainty and information asymmetry between insiders and investors, leading to lower stock returns in the future.

To directly test the information asymmetry reduction mechanism, I use the price impact measure estimated from TAQ data to proxy for information asymmetry. I show that a 10% increase in 8-K downloads significantly reduces the price impact measure by 8 basis points, and equivalently a 20% reduction around the mean.

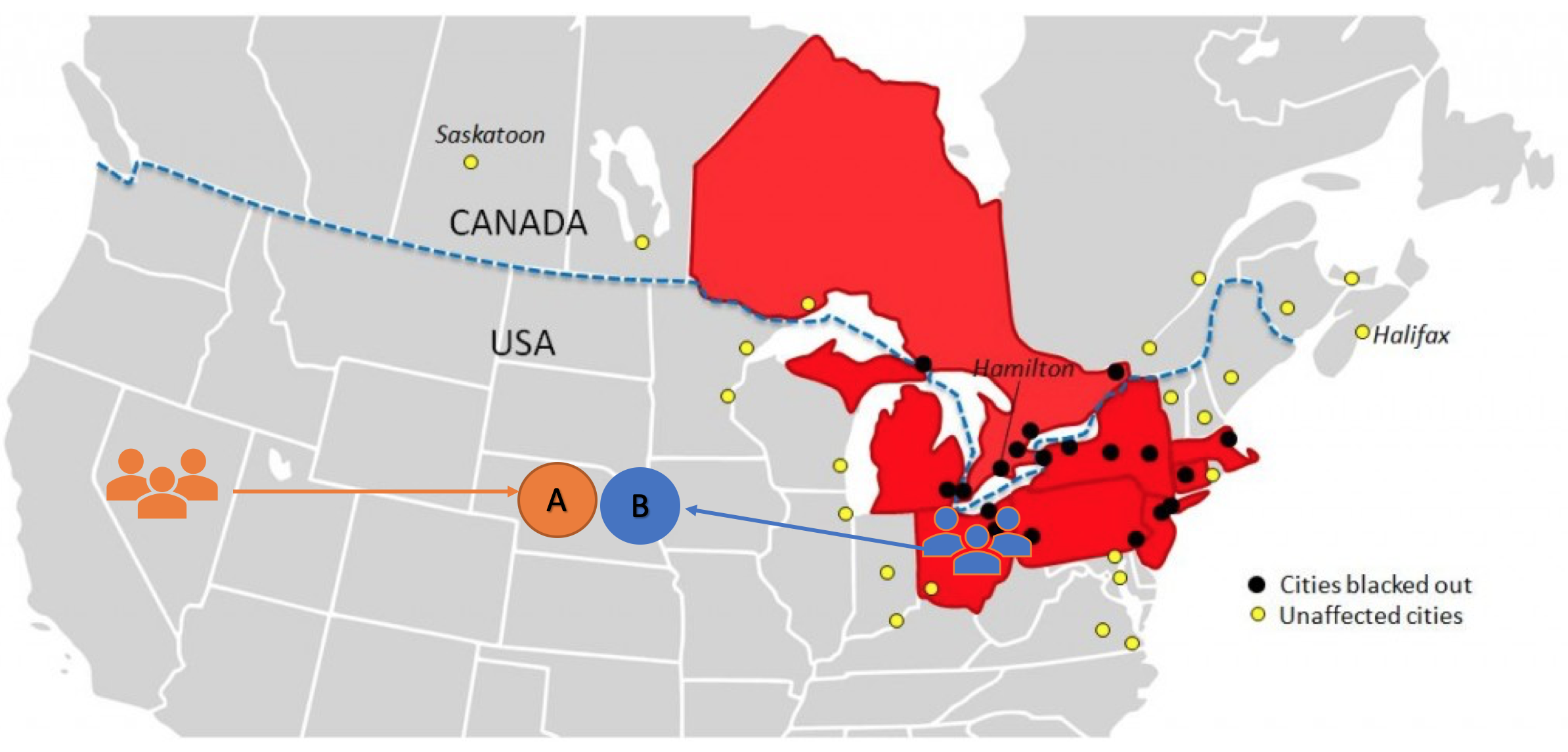

To establish the causal relationship between information acquisition and information asymmetry, we need an exogenous variation in information acquisition. In the paper, I use the Northeast Blackout event as a natural experiment, and use difference-in-differences to estimate the causal effect of information acquisition on information asymmetry.

The blackout limits investors from the east coast region of the US to access firm filings. At the firm level, firms with a higher fraction of historical downloads from the affected region, ex-ante, are going to face a larger reduction in downloading activities during the blackout. The following graph captures the thought experiment. Firm B has a large viewer base from the east coast, whereas Firm A has a large viewer base from the west. When the blackout happens, investors of Firm B is going to have a harder time to acquire information than investors of Firm A. Therefore, compared to Firm A, the information asymmetry of Firm B will increase during the blackout.

I then use the DID to estimate the effect. The treatment intensity is the fraction of historical downloads from the affected region. The sample includes firms with information release one-day prior to the blackout, so that 1) information acquisition in the subsequent periods are crucial, 2) information release is orthogonal to the blackout event. I show that 1% increase in the treatment intensity (more downloads reduction during the blackout) leads to a 3% increase in information asymmetry. The magnitude is similar to the earlier panel regression setting.

Lastly, how to reconcile with the existing findings in the literature?

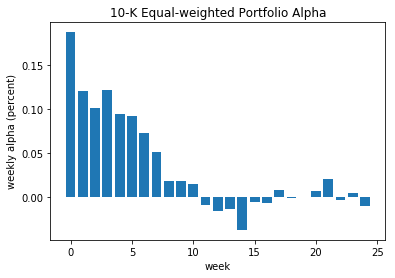

If one simply looks at information acquisition unconditionally, then high information acquisition predicts a positive abnormal return that gradually decays. The following return pattern has been documented in the existing literature.